Cryptocurrencies have been growing in popularity over the years, gaining more and more investors and traders every day. The advent of leverage trading has made the cryptocurrency market even more accessible to traders trying to enhance their profits. In this article, we will delve into crypto leverage trading, including what it is, the advantages and risks, popular strategies, top cryptocurrencies, and platforms. We also gathered tips for successful trading and highlighted the substantial risks to consider before getting started with crypto leverage trading.

Introduction to Crypto Leverage Trading

Leverage trading is an approach used in trading that enables traders to borrow additional funds from exchange platforms to increase their position in a trade. It’s like a loan that traders get to help magnify their profits. This technique is commonly used in traditional markets like forex and stocks, but it has also been adopted in the crypto market.

Crypto leverage trading enables traders to amplify their profits by using borrowed funds, which can potentially result in high returns fast. However, leverage trading can also result in significant and potentially detrimental losses if the trades go against the trader’s position. Therefore, traders need to understand not only the benefits but especially the risks of leverage trading very well before starting to trade crypto with leverage.

Check out What is Slippage in Crypto: Impact, Strategies, and Risks

What is Leverage in Crypto Trading?

Leverage trading in the crypto market is an advanced strategy that allows traders to multiply their potential profits, although it also comes with significantly increased risk. Some platforms offer up to 100x leverage on crypto, meaning that for every $1 a trader puts up as collateral, they can trade $100 worth of a cryptocurrency. Binance is one platform that offers such leverage trading services.

To help with this, many traders use tools like a crypto leverage calculator, which assists in understanding potential profits and losses. A crypto leverage chart can also be helpful to visualize the potential outcomes of various leverage levels. For example, with 50x leverage in crypto, a 1% price movement in your favor could potentially multiply your initial investment by 50.

However, the same is true for a price movement against your position, illustrating why leverage trading isn’t recommended for beginners without careful risk management. As a simpler example, 10x leverage in crypto means that a $100 investment could have the buying power of $1000, but again, the risks are multiplied. It’s essential for anyone interested in leverage trading, especially beginners, to fully understand these concepts and risks before diving in.

Benefits and Risks of Crypto Leverage Trading

Crypto leverage trading has its benefits and risks, just like any other trading technique. Here are some of the benefits and risks to consider before delving into crypto leverage trading.

Benefits

Amplified Profits

The primary benefit of leverage trading is amplified profits. With leverage, traders can invest in larger positions than their capital allows, which can result in higher profits if the trades go in their favor.

Access to More Markets

Leverage trading also provides access to more markets that traders might not be able to access with their capital. This enables traders to diversify their portfolios and potentially increase their profits.

Flexibility

Leverage trading also offers flexibility in terms of trading strategies. Traders can use leverage to open long or short positions, depending on their market predictions, i.e. whether the trader presumes the market for the particular cryptocurrency will go up or down respectively.

Lower capital requirements

Using leverage can allow you to trade with smaller amounts of capital, which can be helpful for traders who are just starting out.

Risks

Amplified Losses

The most significant risk of leverage trading is amplified losses. If the trades go against the trader’s position, the losses are also amplified, potentially leading to significant losses. Many traders have been utterly financially wrecked by such losses, so it is strongly advised to carefully consider the risks before making an informed decision. Hence, the old golden rule shall always be implied – never trade with more money than you are comfortably willing and able to forego.

Margin Calls

Leverage trading also comes with margin calls, which are notifications from the broker or exchange requiring the trader to deposit additional funds to cover the losses. If the trader fails to meet the margin call, the position might be closed automatically, resulting in significant losses.

Emotional Trading

Leverage trading can also lead to emotional trading, where traders make impulsive and irrational decisions based on emotions rather than rigorous market analysis. Emotional trading can lead to significant losses in leverage trading and take a significant toll on a trader’s finances and overall well-being.

Technical failure

Technical issues, such as system failures or connectivity problems, can result in losses when trading with leverage and can never be fully excluded from consideration. Furthermore, the past has already shown multiple times, that keeping your funds in exchange hot wallets can be disastrous in case of hacks or corruption, so be mindful of that.

Example of Crypto Leverage Trading

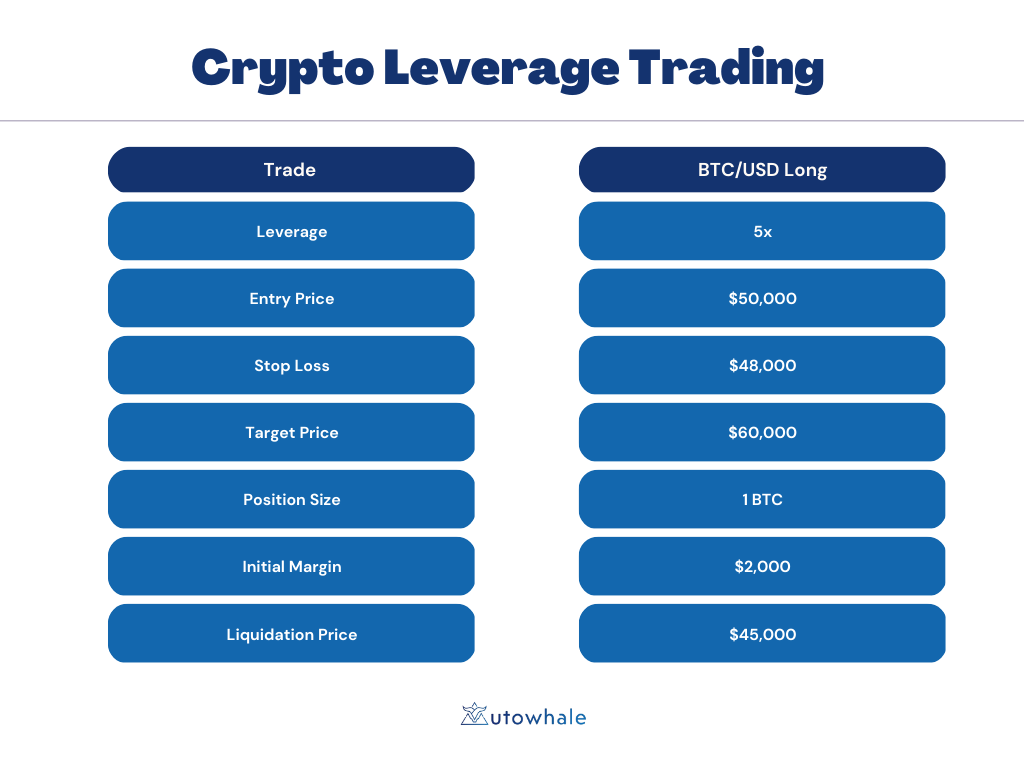

Let’s say you want to buy one Bitcoin at a current price of $50,000. However, you only have $10,000 available to invest. If you use 5x leverage, you can effectively control 5 Bitcoins with your $10,000 initial investment.

So, you decide to open a 5x leveraged long position on Bitcoin at $50,000. You put up $2,000 as your initial margin (which is 20% of your total position size) and borrow the remaining $40,000 from the exchange.

If the price of Bitcoin goes up to $60,000, you would make a profit of $50,000 – $50,000 / 5 (leverage) = $40,000. Subtracting the borrowed $40,000 and the $2,000 initial margin, your net profit would be $40,000 – $40,000 – $2,000 = $38,000.

However, if the price of Bitcoin drops to $45,000, your position will be liquidated as you have reached the stop loss level (which you had set at $48,000). In this case, you would lose your initial margin of $2,000.

Note that leverage trading involves a higher level of risk as the potential gains and losses are amplified. It is therefore crucial to have a good understanding of the market and the risks involved before using leverage and be aware of your own status and capabilities.

Popular Crypto Leverage Trading Strategies

There are various trading strategies that traders can use when trading cryptocurrencies with leverage. Here are some of the popular strategies:

Day Trading

Day trading is a popular strategy in all markets, including the crypto market. Day traders open and close positions within the same day, aiming to profit from small price movements. Day trading requires a solid understanding of market analysis and risk management.

Swing Trading

Swing trading is a strategy that involves opening positions for several days or weeks, aiming to profit from medium-term price movements. Swing traders use technical analysis to identify trends and make trading decisions.

Scalping

Scalping is a strategy that involves opening and closing positions quickly, aiming to profit from small price movements. Scalpers use technical analysis and market depth to identify short-term opportunities.

Position Trading

Position trading is a strategy that involves holding positions for several months or years, aiming to profit from long-term price movements. Position traders use fundamental analysis to identify undervalued assets and hold the positions for an extended period.

Top Cryptocurrencies for Leverage Trading

Leverage trading in cryptocurrencies is a popular way to amplify potential returns, but it also comes with increased risks. The list is long, but here are some of the top cryptocurrencies for leverage trading based on web search results:

Bitcoin (BTC): Bitcoin is the most popular and widely traded cryptocurrency and is available for leverage trading on many platforms.

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and is also commonly traded on leverage.

Binance Coin (BNB): Binance Coin is the native token of the Binance exchange, which offers high-leverage trading options.

Cardano (ADA): Cardano is a newer cryptocurrency that has gained popularity among traders for its potential high returns.

Ripple (XRP): Ripple is a digital currency designed for international money transfers and is available for leverage trading on many platforms.

Top Leverage Trading Platforms

Traders may utilize a variety of trading platforms to trade cryptocurrencies with leverage. BitMEX is a well-known platform for trading cryptocurrencies such as Ethereum, Bitcoin, and Ripple, and it provides up to 100x leverage on some of its products. Binance is another prominent exchange that offers up to 125x leverage, while Bybit gives up to 100x leverage with a simple UI. Kraken, a cryptocurrency exchange, also provides leveraged trading for certain assets, including cryptocurrencies. Presently, Kraken offers traders up to 5x leverage.

Tips for Crypto Leverage Trading

Leverage trading in the cryptocurrency market can be a lucrative way to increase your profits, but it can also be risky if you don’t know what you’re doing. Here are some tips for successful crypto leverage trading:

Understand the risks: Leverage trading is inherently very risky because it involves borrowing money to trade with. Make sure you understand how leverage works and all the potential risks before you start trading.

Choose a reliable exchange: Choose a reputable exchange that offers leverage trading, has a good track record, and has strong security measures in place.

Use stop-loss orders: A stop-loss order is an order to sell a cryptocurrency when it reaches a certain price. This can help limit your losses if the market suddenly turns against you.

Start small: Don’t jump into leverage trading with a large amount of money. Start small and work your way up as you gain more experience.

Have a trading plan: Develop a trading plan that outlines your goals, risk tolerance, and strategies for entering and exiting trades.

Keep an eye on the market: Keep up-to-date with market news and price movements so you can make informed trading decisions.

Use technical analysis: Use technical analysis tools to identify trends and potential entry and exit points.

Don’t get emotional: Trading can be emotional, especially when you’re dealing with large amounts of money. Try to keep a level head and stick to your trading plan. If you notice you’re getting too worked up, then stop trading and secure your funds.

Use leverage responsibly: Don’t over-leverage yourself by borrowing too much money to trade with. Use leverage responsibly and only trade with money you can easily afford to lose.

Practice with a demo account: Many exchanges offer demo accounts that allow you to practice trading with fake money. This can be a great way to gain experience and test your strategies before risking real money.

Is Crypto Leverage Trading Right for You?

If done properly, crypto leverage trading may be a profitable trading strategy. But, it also has significant risks that traders must consider before investing. To be effective in crypto leverage trading, traders must have a basic grasp of leverage, use correct risk management measures, constantly stay up-to-date about market news and trends, and keep their emotions in check. If you’re contemplating crypto leverage trading, do your own research and choose a platform that meets your trading requirements.

Frequently Ask Questions (FAQ)

What is crypto leverage trading?

Crypto leverage trading is a method in cryptocurrency trading where the trader borrows funds to increase their trading position beyond what would be available from their cash balance alone. It essentially allows traders to multiply their buying power.

Can you leverage trade on crypto?

Yes, you can leverage trade on crypto. Many cryptocurrency exchanges offer leverage trading. However, it’s important to note that while leverage can amplify profits, it can also amplify losses.

What is 20x leverage on $100?

20x leverage on $100 means you are borrowing to control a position worth $2000. If the value of the position increases by 5%, instead of gaining $5 (as you would without leverage), you would gain $100 (5% of $2000). But remember, if the position decreases by 5%, you would lose $100, which could exceed your initial investment.

What is a good leverage ratio for crypto?

The “good” leverage ratio for crypto can vary greatly depending on a trader’s risk tolerance, experience, and the specific strategy being used. For beginners, it’s often recommended to stick with lower leverage, like 2:1 or 3:1, to minimize potential losses. Experienced traders may use higher leverage, but it’s always important to understand the risks involved.

None of the content above is financial advice and is for educational purposes only. Find more content on algorithmic trading software, crypto market making and market microstructure on Autowhale’s blog.