Crypto options trading is a complex but interesting way for traders to buy or sell a cryptocurrency at a set price within a specific time.

This type of trading has proliferated as the cryptocurrency market experiences expansion. For beginners, the idea of crypto options trading can be confusing and hard to understand.

Check out : Web3 Startups 2023

What is Crypto Options Trading

Crypto options trading is a way to buy or sell cryptocurrencies at a set price within a specific time. It allows traders to make money from both rising and falling prices in the cryptocurrency market. For example, a trader who thinks Bitcoin’s price will go up can buy a call option at a certain price. If the price rises above that amount, the trader can use the option to get Bitcoin at a cheaper rate. If the price goes down below that price, the trader can just let the option run out.

While crypto options trading can lead to big profits, it also has a lot of risk. The unpredictable nature of the cryptocurrency market can cause fast and big price changes for the asset, which could lead to big losses for new traders or those who don’t understand the market well.

In short, crypto options trading offers an exciting and possibly profitable way for traders to take part in the cryptocurrency market. However, it’s crucial for traders to research thoroughly, create a solid trading strategy, and exercise caution when entering the market.

Evaluating Top Crypto Options Trading Platforms of 2023

Selecting the right trading platform can make a significant difference in your crypto options trading experience. Before choosing the trading platform that will serve you best, it’s crucial to weigh different aspects to ensure it aligns well with your specific requirements and preferences. Here are the main criteria we used to evaluate the top crypto options trading platforms of 2023:

User Interface: When it comes to the user interface, the design of the platform should be straightforward and easy to navigate, offering a pleasant experience for both beginners and experienced traders. The best platforms make trading as seamless as possible by offering features like real-time charts, customizable dashboards, and efficient trading processes.

Security: Security is crucial when it comes to dealing with cryptocurrencies. Security considerations are a key part of choosing a platform. This includes looking at safety measures like the use of two-step verification, encryption of user data, and whether they have insurance coverages in place. These factors are vital in keeping your investment assets safe and secure.

Fees: Different platforms charge varying fees for trading crypto options. These fees can include transaction fees, withdrawal fees, and others. It’s essential to be aware of these charges, as they can impact your profitability.

Available Cryptocurrencies: The best platforms offer a wide variety of cryptocurrencies for options trading, including Bitcoin, Ethereum, and more. More options allow you to diversify your portfolio and capitalize on different market trends.

Geographical Availability: Depending on your location, some platforms may not be available. Consider platforms that are accessible in your region and check their compliance with local regulatory requirements.

By considering these aspects, you’ll be able to find the best crypto options trading platform in the US or any other part of the world.

In the following sections, we will take a detailed look at some of the most notable platforms in 2023, including popular platforms like Deribit and others that offer crypto options trading. By evaluating each platform based on the criteria mentioned above, we aim to provide a comprehensive guide for anyone interested in crypto options trading.

Check out : Web3 Startups 2023

Crypto Options Trading Platforms Comparison

| Platform | Contracts Offered | Trading Fees | Key Features | User Interface |

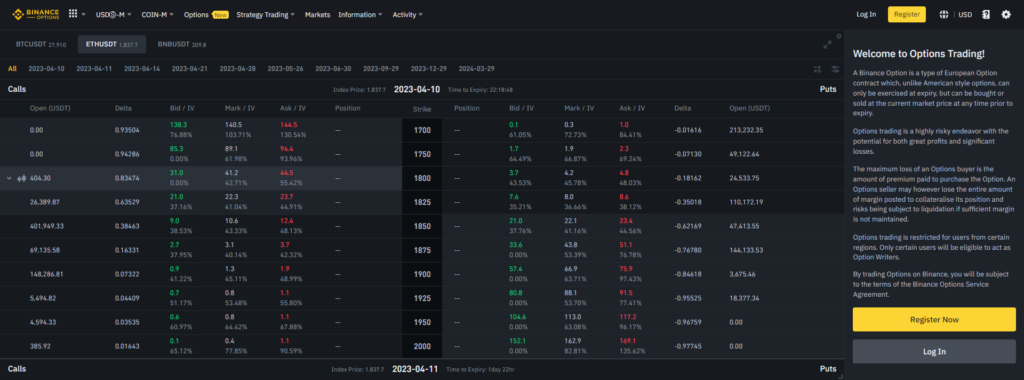

| Binance Options | BTC, ETH, and major cryptocurrencies | 0.02% transaction fees, 0.015% exercise fees | Stablecoin priced and settled, low fees | User-friendly, advanced features |

| Deribit | BTC, ETH, and major cryptocurrencies | 100% reduction in fees for second option leg(s) in certain combos | High liquidity, low fees, options combo fee discounts | User-friendly, advanced features |

| OKX Options | BTC, ETH, and major cryptocurrencies | Competitive fees | Simple Options contracts, European style, various expiration times | User-friendly, simplified UI |

| LedgerX | BTC and ETH | Varying trading fees | Bitcoin Mini Options, Ethereum Deci Options, regulated platform | Advanced features, institutional-grade infrastructure |

| Crypto Facilities | BTC and ETH | N/A | Inverse crypto-collateral perpetual contracts, non-expiring settlement, high liquidity | Advanced features, high liquidity |

| Huobi Options | BTC, ETH, and major cryptocurrencies | Competitive fees | Call and put options, leverage, controllable risk, high yield, simple purchase process, USDT settled | User-friendly interface |

Top Crypto Options Trading Platforms of 2023: An In-Depth Look

Binance Options

Binance Options is a popular options trading platform that is known for its user-friendly interface and advanced trading features. The platform offers a range of options contracts, including Bitcoin, Ethereum, and other major cryptocurrencies.

Security measures and Regulatory Compliance

- Binance uses two-factor authentication with multiple methods such as hardware, app-based, SMS, and email.

- Advanced access control includes features like IP and wallet address whitelisting, API access control, and device management.

- User data and personal information, including KYC details, are encrypted in storage.

- Data in transit is secured via end-to-end encryption, ensuring personal information access is limited to the user.

- Binance collaborates with regulators and third parties to establish clear regulatory frameworks and standards for global crypto compliance.

- In regions with underdeveloped regulation, Binance proactively sets initiatives for user protection.

- Despite these measures, Binance faces legal action from the US Commodity Futures Trading Commission (CFTC) for alleged regulatory violations, including failure to register with the agency.

Deribit

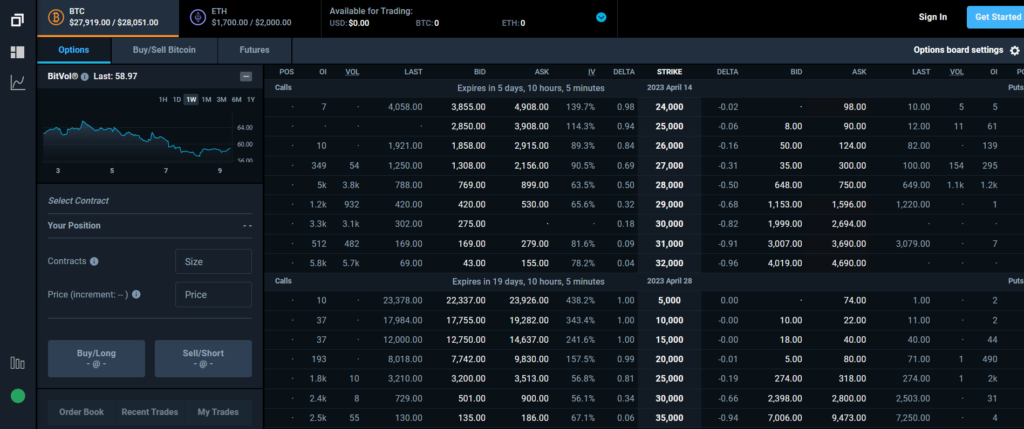

Deribit is a popular crypto options trading platform that is known for its high liquidity and low trading fees. The platform offers a range of options contracts, including Bitcoin, Ethereum, and other major cryptocurrencies.

Security measures and Regulatory Compliance

- Deribit is a security-focused cryptocurrency exchange offering options and futures trading.

- The exchange employs extensive cybersecurity measures and technical protocols to protect user assets.

- A dedicated security page on Deribit’s website offers guidance on secure trading practices for users.

- Deribit partners with Eventus, a surveillance platform provider, to enhance trade surveillance and security.

- As Dubai tightens its regulations, Deribit is planning to relocate its operations there.

OKX Options

OKX Options is a popular options trading platform that is known for its user-friendly interface and competitive trading fees. The platform offers a range of options contracts, including Bitcoin, Ethereum, and other major cryptocurrencies.

Security measures and Regulatory Compliance

- OKX employs measures like SSL communication encryption and mandatory two-factor authentication for information security.

- The exchange has a clear privacy policy that states its commitment to information security.

- OKX provides a dedicated webpage explaining configurable compliance measures.

- OKX isn’t available to US users due to regulatory and compliance concerns.

- The terms of service of OKX detail its current technology capacity and other conditions.

- To prevent denial of service attacks, OKX may limit the number of orders via the API and monitor API messages.

- Investigations are carried out by OKX to meet legal and regulatory requirements, and to ensure the smooth operation of the platform.

- OKX educates users about the risks of trading digital assets and other services it offers.

- Regulators expect exchanges like OKX to follow best security practices and adhere to KYC, AML, and CFT regulations.

LedgerX

LedgerX is a derivatives exchange that offers options contracts on Bitcoin. The platform is known for its advanced trading features and institutional-grade infrastructure.

Security measures and Regulatory Compliance

- LedgerX is a US-based exchange and clearinghouse regulated by the US Commodity Futures Trading Commission (CFTC).

- It holds three licenses with the CFTC and is bound by the core principles of the Commodity Exchange Act, including security and Anti-Money Laundering (AML) measures.

- LedgerX has defined standards and procedures aimed at user protection and security.

- The exchange provides a regulatory compliance chart illustrating each core principle along with relevant rule citations.

- LedgerX was recently acquired by Miami International Holdings, a CFTC-regulated exchange and clearinghouse based in Miami, Florida.

Crypto Facilities

Crypto Facilities is a derivatives exchange that offers options contracts on Bitcoin and Ethereum. The platform is known for its advanced trading features and high liquidity.

Security measures and Regulatory Compliance

- Crypto Facilities is a UK-based exchange offering cryptocurrency futures and options trading.

- The exchange is registered with the UK’s Financial Conduct Authority (FCA), demonstrating its commitment to regulatory compliance.

- Specific information regarding Crypto Facilities’ security measures is currently limited.

Huobi Options

Huobi Options is a popular options trading platform that is known for its user-friendly interface and competitive trading fees. The platform offers a range of options contracts, including Bitcoin, Ethereum, and other major cryptocurrencies.

Security measures and Regulatory Compliance

- Huobi is a cryptocurrency exchange that employs Know-Your-Customers (KYC) and Anti-Money Laundering (AML) policies for regulatory compliance.

- The exchange has a robust compliance framework meeting both local and global regulatory standards.

- Huobi’s privacy policy assures the implementation of protection measures for personal information as per legal requirements.

- Huobi enforces trading regulations that adhere to the platform’s risk control audit requirements.

- Integration with Fireblocks Network enhances Huobi’s connectivity, asset security, and user experience.

- Huobi Trust Hong Kong provides robust security and compliance measures, including AML/CTF policies, to all cryptocurrency investors.

Exploring Bitcoin Options Trading

Trading options in the crypto market has become increasingly popular, and numerous platforms now offer such services. Robinhood, traditionally known for its stock trading features, has stepped into this arena with Robinhood crypto options. Meanwhile, numerous platforms compete for the title of the best crypto options trading platform in the US, offering a variety of features to attract traders.

An integral tool for any options trader is the option chain, which provides detailed information about various strike prices and expiration dates; Bitcoin option chains are now a staple of many platforms. Deribit is a well-known exchange that specializes in Bitcoin options and futures. Understanding Bitcoin options prices is crucial for making informed trading decisions, and many platforms provide this data.

To help visualize this, some traders rely on a Bitcoin options chart, which maps out price movements over time. Furthermore, established financial marketplaces like CME have entered the crypto sphere, offering sophisticated financial instruments such as CME Bitcoin options. All these elements together are contributing to a more diversified and mature crypto trading landscape.

How to Understand and Evaluate Bitcoin Options Prices

Breaking Down How Bitcoin Options Prices are Determined

The price of a Bitcoin option, often referred to as its premium, is shaped by a number of different elements. These include:

The current price of Bitcoin: If the market price of Bitcoin is close to the strike price of the option, the premium is likely to be higher.

The volatility of Bitcoin: The more unpredictable Bitcoin’s price, the higher the potential for profit—and risk. This volatility can drive up the premium.

Time until the option’s expiry: Options with more time left until expiry tend to have higher premiums, since there’s more time for the price of Bitcoin to hit the strike price.

Risk-free interest rate: The risk-free interest rate also affects the premium, although its impact is often minor in the crypto world.

Why Analyzing Bitcoin Options Prices is Crucial

Analyzing Bitcoin options prices is key for any trader. This is because the option’s premium can provide insight into market expectations. High premiums can indicate that traders expect large price swings, while low premiums may suggest a period of stability.

Understanding these prices can also help traders strategize. For instance, if premiums are high, a trader may decide to sell options to capitalize on the expensive premiums. Alternatively, if premiums are low and a price swing is expected, a trader might buy options.

In summary, understanding how Bitcoin options prices are calculated, and their implications, is key to making informed trading decisions. By regularly consulting the Bitcoin options chart and staying up to date on market trends, traders can optimize their strategies to maximize profit and mitigate risk.

Upcoming Trends: Crypto Options Trading in 2023

Anticipated Developments in Crypto Options Trading

The world of crypto options trading is expanding fast. Here are some trends we foresee:

Increased participation from big-time investors: With an increasing number of heavyweight investors exploring the crypto market, they’ll seek ways to balance their risks while gaining a foothold in the sector. Options trading is well-suited to these needs, providing investors with ways to manage potential risks and profits.

Development of advanced trading approaches: As the market comes of age, expect to see the emergence of more advanced trading strategies. For instance, traders could use options to establish synthetic long or short positions, or guard against potential losses.

Tightening of regulations: With the ever-growing crypto market capturing global attention, governments are beginning to take a closer look. This may result in tighter regulation of crypto options trading, altering the operation of the market.

Promising Platforms on the Horizon

As discussed in the article, several emerging platforms are worth keeping an eye on. These includes:

Bybit: This is a top-tier crypto derivatives exchange offering a broad spectrum of options contracts. Known for its high liquidity and competitive trading fees, Bybit is a strong contender.

Deribit: Another big name in crypto options trading, Deribit offers an array of features, including futures contracts, margin trading, and a wide range of order types.

OKEX Options: This relatively new player provides a variety of options contracts on Bitcoin, Ethereum, and other major cryptocurrencies. Users appreciate its high liquidity and easy-to-use interface.

Impact of Regulatory Shifts on Trading

The rules governing crypto options trading are still in flux. But as governments worldwide begin to pay more attention to the sector, we can anticipate more regulation. This could change how the market functions, and potentially make it harder for some traders to get involved.

Conclusion

In the ever-evolving realm of cryptocurrency trading, the onset of 2023 is anticipated to usher in the prominence of leading crypto options trading platforms, drawing traders from across the globe.

Showcasing an extensive array of options contracts, competitive fees, and state-of-the-art trading capabilities, these platforms are designed to serve the demands of both novice and seasoned traders.

As the cryptocurrency market experiences swift expansion and progression, these platforms are projected to emerge as a vital component of the industry’s infrastructure, dramatically altering the methods traders employ in their strategies and exerting a wide-ranging influence on the entire ecosystem. Consequently, traders should be prepared to harness the potential of these platforms, propelling their trading adventures to unprecedented pinnacles!

Frequently Ask Questions

Is there options trading for crypto?

Yes, options trading for crypto is available on various platforms like Binance Options, Deribit, and OKX Options.

Is crypto options profitable?

Crypto options can be profitable, but it depends on the trader’s knowledge, strategy, and risk management.

Can you trade options in Kucoin?

Kucoin does not currently offer options trading.

How big is crypto options market?

The crypto options market is expanding rapidly, reflecting increased interest and participation; however, the exact size fluctuates over time.

According to the block the joint trading volume for Bitcoin and Ethereum options exceeded $387 billion in 2021.

What is the best platform for options trading in crypto?

One of the few popular platforms for options trading in crypto are Binance Options, Deribit, and OKX Options.

None of the content above is financial advice and is for educational purposes only. Find more content on algorithmic trading software, crypto market making and market microstructure on Autowhale’s blog.